Union Credit Wins Finovate Award for Top Emerging Fintech Company

Fintech startup recognized for marketplace of trusted lenders that will change the game for credit unions and bring consumers more equitable choices

Fintech startup recognized for marketplace of trusted lenders that will change the game for credit unions and bring consumers more equitable choices

KATHRYN REED FOR THE NORTH BAY BUSINESS JOURNAL August 3, 2023 Instead of retiring a year ago at age 45, which was Dave Buerger’s original

CUs must put themselves out there, reveal the best version of themselves and show consumers why they should be The One.

Select fintech partners based on your CU’s specific growth goals and begin conversations about partnerships at the board level.

Union Credit, a credit offer provider, has introduced a marketplace to allow credit unions to offer one-click credit offers to customers at the point-of purchase.

We are excited to announce that we have been selected as a finalist for the ‘Top Emerging Fintech Company!’ We are delighted to share the

Union Credit has launched its first marketplace for credit unions, allowing them to make secure and efficient credit offers at the point of purchase.

Mission focused Fintech takes on challenge of bringing the next generation of membership to credit unions and offering consumers more equitable choices SANTA ROSA, Calif.–(BUSINESS

Credit unions are looking to digital lending marketplace Union Credit to grow their membership, gain national exposure and break into younger demographics.

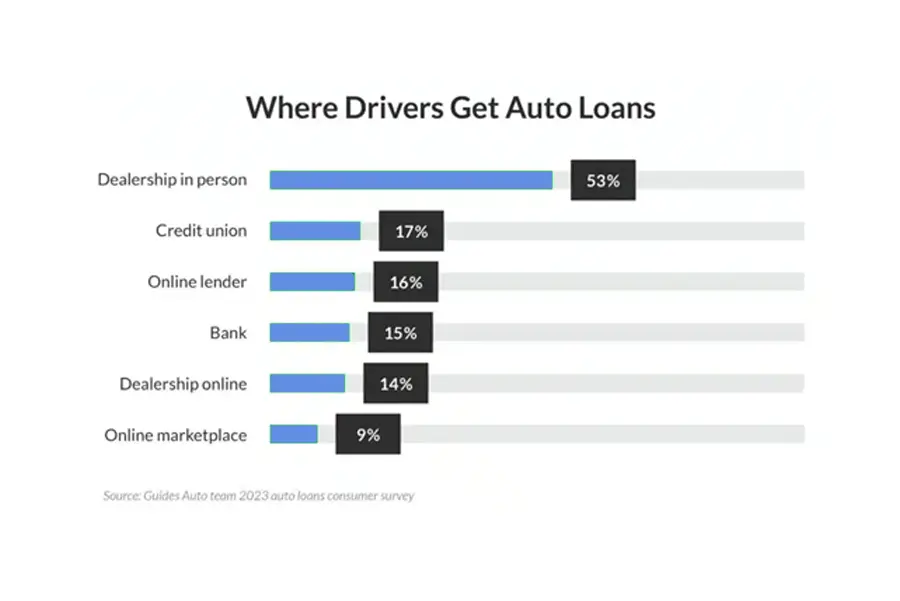

For those in the market for a new car or refinancing a loan for one they’ve already purchased, money generally comes from banks, but credit